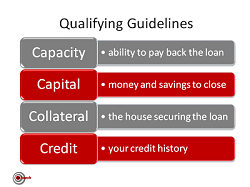

The Qualified Mortgage Rule came into effect on January 14, 2014 as one of the results to the Dodd Frank Reform Act to protect consumers from predatory lending practices. This will affect the underwriting standards that the majority of lenders will use to qualify borrowers.

The ability to repay rule states that financial information must be supplied by the borrower and verified by the lender. The borrower must have sufficient assets or income to pay back the loan which limits the maximum debt-to-income ratio of 43%. In an effort to present a more accurate picture of the costs to the borrower, teaser rates can no longer hide a mortgage’s true cost.

A maximum of 3% in upfront points and fees can be paid on behalf of the borrower. There can be no negative amortization, interest-only or balloon payments and the loan term limit cannot exceed 30 years.

While there are more requirements, most deal with good underwriting practices that are followed by reputable lenders such as considering and verifying things that affect the ability to repay the mortgage like income, assets, employment status, simultaneous loans, debt, alimony, child support and credit history.

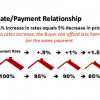

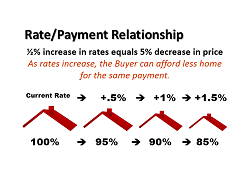

A ½% increase in interest rate may not sound like much but it is roughly equivalent to a 5% increase in price. It becomes obvious when you compare the payments.

A ½% increase in interest rate may not sound like much but it is roughly equivalent to a 5% increase in price. It becomes obvious when you compare the payments.

Whether you continue to rent or decide to buy a home, according to recent

Whether you continue to rent or decide to buy a home, according to recent

You’ll need to earn $2.00 for every $1.00 you want to spend assuming you pay 50% of your earnings on income tax, social security and Medicare. On the other hand, you get to keep 100% of every dollar you save on your personal expenses because the taxes have already been paid.

You’ll need to earn $2.00 for every $1.00 you want to spend assuming you pay 50% of your earnings on income tax, social security and Medicare. On the other hand, you get to keep 100% of every dollar you save on your personal expenses because the taxes have already been paid.

“I’d wish I’d know that before I made a decision.” If you’ve ever regrettably said this to yourself, having a checklist might have prevented the issue in the first place. This list of questions can provide you with things to discuss when interviewing a moving company.

“I’d wish I’d know that before I made a decision.” If you’ve ever regrettably said this to yourself, having a checklist might have prevented the issue in the first place. This list of questions can provide you with things to discuss when interviewing a moving company.

The two most frequently quoted constants in life are death and taxes. Two more things would-be homeowners can expect in the near future are increases in mortgage rates and housing prices.

The two most frequently quoted constants in life are death and taxes. Two more things would-be homeowners can expect in the near future are increases in mortgage rates and housing prices.

One of the most frequent calls from homeowners to their agents is about the listing’s inactivity due to the lack of showings. The homeowner commonly believes that the home is shown only when a buyer walks through the house with an agent.

One of the most frequent calls from homeowners to their agents is about the listing’s inactivity due to the lack of showings. The homeowner commonly believes that the home is shown only when a buyer walks through the house with an agent.