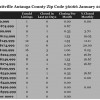

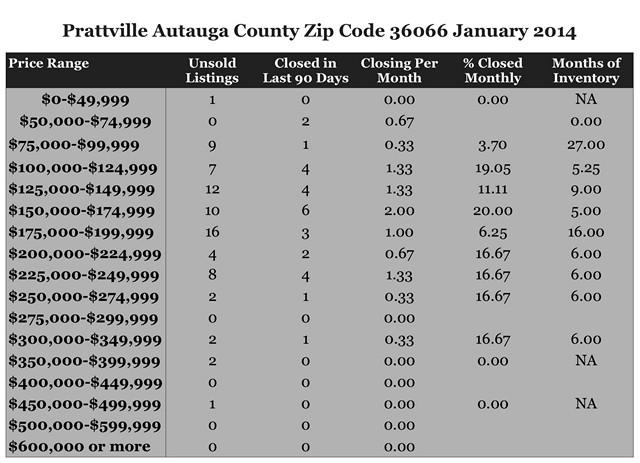

These were the existing Homes for Sales January 2014 for Zip Code 36066 in Prattville and Autauga County including subdivisions Greystone, Riverchase, Woodland Heights, Silver Hills, Eastwood, The Homeplace, and The Villas at Brookstone. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure means a better bargain for buyers. For a personalized report, feel free to contact me.

January 2014 Home Sales Zip Code 36066

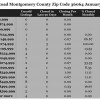

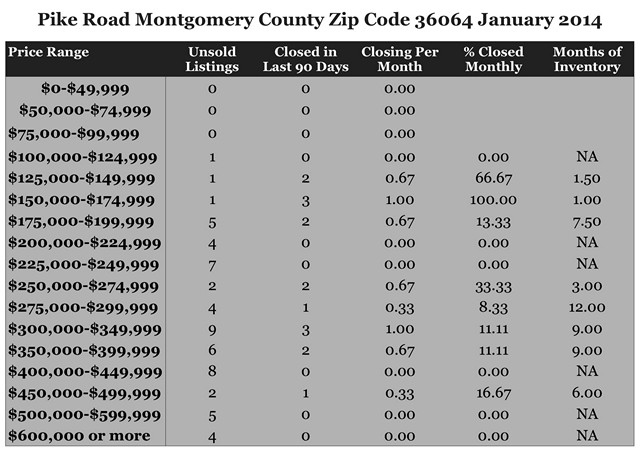

January 2014 Home Sales Zip Code 36064

These were the existing Homes for Sale January 2014 for Zip Code 36064 for Pike Road and eastern Montgomery County including subdivisions Bon Terre, Woodland Creek, Bridle Brook, Avalon, Merrywood, Foxwood Providence and The Waters. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a chance for a better bargain for a buyer. For a personalized report, feel free to contact me.

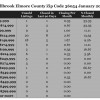

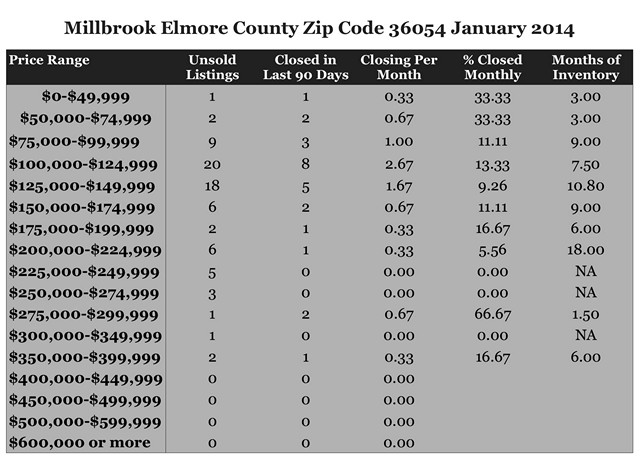

January 2014 Home Sales Zip Code 36054

These were the existing Homes for Sale January 2014 for Zip Code 36054 for Millbrook and Elmore County including subdivisions Thornfield, Grandview Pines, Mill Ridge, Winter Lake, Magnolia Ridge, Stoney Brook, Mountain View, Bishop Place, Jamestown, Grand Oaks, Timberbrook Estates, Plantation Oaks, and The Columns. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a chance for a better bargain for buyers. For a personalized report, feel free to contact me.

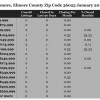

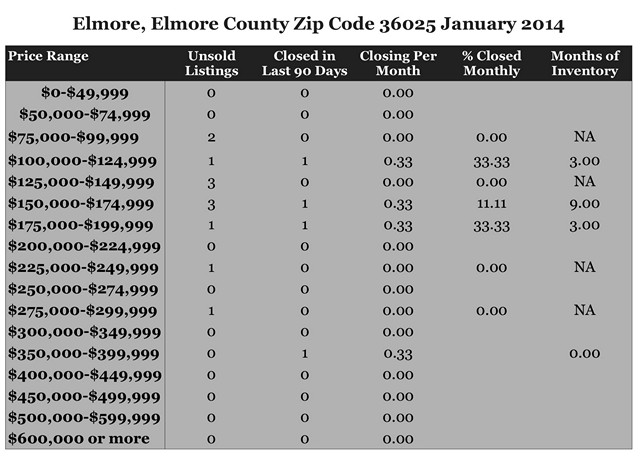

January 2014 Home Sales Zip Code 36025

These were the Existing Homes for January 2014 for Zip Code 36025 for the community of Elmore in Elmore County including subdivisions Ferndale, Meadowview, Turtle Trace, Crossgate, Silver Ridge, Diamond Oaks, Brittany Place, Brownstone and Charleston Place. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

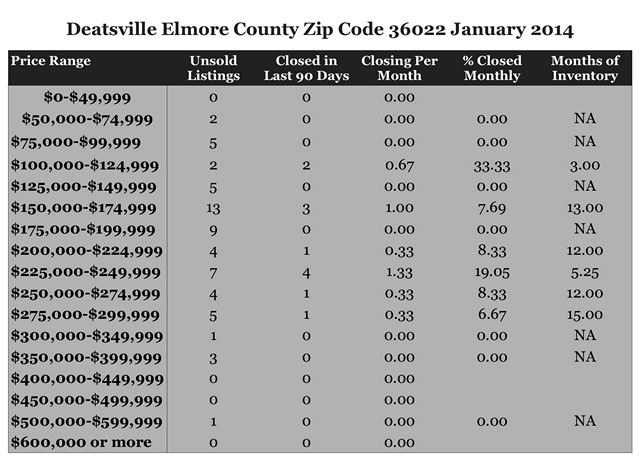

January 2014 Home Sales Zip Code 36022 Elmore County

These were the Existing Homes for January 2014 for Zip Code 36022 for Deatsville and Elmore County including Holtville, Slapout, and part of Lake Jordan communities and subdivisions Spring Hollow, Richfield, Brookshire, Wind Mill Ridge, Dillons Run, Coosa Ridge, Green Acres, Foxwood, Plantation Ridge, Stoneybrooke Plantation, Turner’s Place, Bridlewood, Bellview Heights, Indian Hills, Meadowview, Sagewood, Kimrick Estates, Country Side Estates, The Forest, Grand Park, Summerfield, Cotton Terrace, Autumn Springs, Forest Heights, Cruise Farm Estates, Breckenridge Crescent Ridge, Savannah Trace, Wynridge, Blackberry, Ridgedale Estates, Country Oaks, Copper Ridge, and Cobblestone Run. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

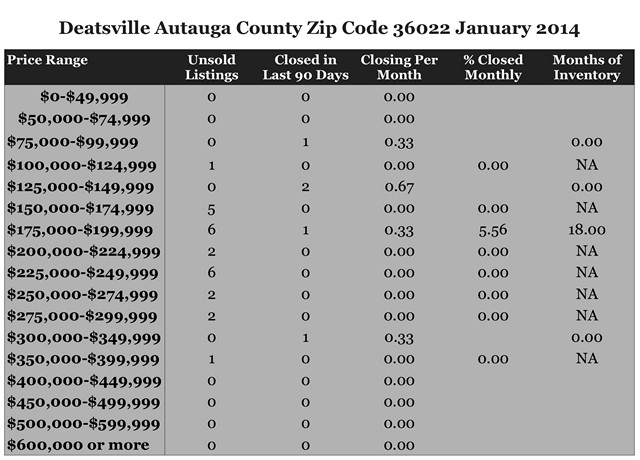

January 2014 Home Sales Zip Code 36022 Autauga County

These were the Existing Home Sales for January 2014 for Zip Code 36022 in Deatsville and Autauga County including Pine Level, and subdivisions Graham Ridge, Rosegate, Caroline Estates, Dogwood Estates, Garden Park, Pinetuckett, Hidden Valley, Hummingbird Place, The Planes, Honeysuckle Ridge, Rushmore, Northpointe, Grand Park, Alpine Hills, Tatum Fields, Mountain Creek, Dogwood Lake Estates, Percy Place, Clear Branch, Oak Valley, and Hunter’s Trail. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

Rent or Buy – the cost is going up

Whether you continue to rent or decide to buy a home, according to recent Zillow 2014 housing projections, the cost is going up. Zillow projects home prices to increase nationally by 3%, mortgages to rise to 5% interest rate by the end of the year and rents to go up by 2.5% on average.

Whether you continue to rent or decide to buy a home, according to recent Zillow 2014 housing projections, the cost is going up. Zillow projects home prices to increase nationally by 3%, mortgages to rise to 5% interest rate by the end of the year and rents to go up by 2.5% on average.

If it will cost a person more whether they rent or buy, the conclusion can be made that one way or the other, they will pay for the house they occupy. The question will be whether they buy it for themselves or their landlord? Will they benefit from the equity build-up and the appreciation?

The following analysis looks at a $200,000 home that can be purchased with a 30 year FHA mortgage at 4.3%. The assumption uses 3% appreciation and tenant currently paying $1,750 a month in rent.

The house payment, principal, interest, taxes and insurance would be about $1,609 a month. However, once you consider the benefits of the principal reduction each month, the appreciation and the tax savings and the increased cost of maintenance, the net cost of housing is closer to $630 per month.

Even if you ignored the tax savings, the net cost of housing would only be $919.06 per month. The tenant would pay considerably more to rent than to own the home. Over time, the decision to buy a home could result in a considerable financial asset that the tenant will not benefit from.

To estimate your cost of housing, use the Rent vs. Own.

Find a Better Return

A certificate of deposit will generate a cash flow based on the interest rate that it pays which is the only way it generates a return for the investor.

An investment in a stock that doesn’t pay dividends, would need to be worth more than you paid for it to earn a profit. On the other hand, a stock that paid dividends could make the investor a profit even if it sold for the same price that he paid for it.

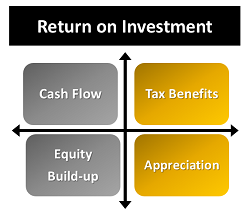

Investors can profit four different ways with an investment in rental real estate.

1. Cash flows that result from having a surplus after collecting the rent and paying the expenses.

2. Equity build-up results from a portion of each monthly payment reducing the unpaid balance.

3. Tax benefits can result from the depreciation allowed on the property and the preferential long-term capital gains tax rate.

4. Appreciation benefits the investor when the value of the property increases.

The most conservative investors in real estate make decisions to purchase a rental property based on its ability to generate a cash flow and reduce the mortgage through normal amortization. If the property can offer an acceptable rate of return compared to other available investments, the tax benefits and possible appreciation become an added bonus.

With increased rents and low mortgage rates for investors, rental property can offer significantly higher returns than many of the available alternatives. Contact me for more information-Judd@MontgomeryRealEstateGuy.com. You may be amazed about what is available in the market.

Personal Finance Review

You’ll need to earn $2.00 for every $1.00 you want to spend assuming you pay 50% of your earnings on income tax, social security and Medicare. On the other hand, you get to keep 100% of every dollar you save on your personal expenses because the taxes have already been paid.

You’ll need to earn $2.00 for every $1.00 you want to spend assuming you pay 50% of your earnings on income tax, social security and Medicare. On the other hand, you get to keep 100% of every dollar you save on your personal expenses because the taxes have already been paid.

Periodically, review your expenditures with the diligence of an exuberant IRS agent on commission. It’s an exercise that most people don’t feel they have time to do but the rewards make it entirely worthwhile.

- Get comparative quotes on insurance – car, home, other

- Review and compare utility providers

- Review plans on cell phones

- Review plans on cable TV, satellite for unused channels and packages or receivers

- Review available discounts on property taxes

- Consider refinancing home – lower rate, shorter term or cash out to payoff higher rate loans

- Consider refinancing cars

- Call credit card companies to ask for a lower rate

- Review all of the automatic charges on your credit cards – consider no-fee cards

- Search for late fees that are regularly being paid and eliminate them.

- Review all bank charges for accounts and debit cards; determine if they can be reduced or eliminated.

If you don’t want to review your credit card accounts, consider reporting the cards stolen so that new numbers will be issued. You can notify the companies that need your number. Companies who might have your number won’t be able to automatically renew services that you may no longer be using. You can be assured that they’ll contact you when the old number doesn’t go through and you can re-evaluate the decision at that time.

Interviewing a Mover

“I’d wish I’d know that before I made a decision.” If you’ve ever regrettably said this to yourself, having a checklist might have prevented the issue in the first place. This list of questions can provide you with things to discuss when interviewing a moving company.

“I’d wish I’d know that before I made a decision.” If you’ve ever regrettably said this to yourself, having a checklist might have prevented the issue in the first place. This list of questions can provide you with things to discuss when interviewing a moving company.

Fees

- What is the charge for packing?

- Does it include boxes? If not, what do they cost and will you deliver them?

- Is there an additional charge to deliver some items to a storage unit?

Insurance

- How is a damage claim handled?

- What insurance do you provide and is there a cost?

- Does the insurance cover items packed by the owner?

- Can additional insurance be purchased?

- If items are covered by my Homeowner’s insurance, whose insurance pays first?

Unusual Items

- Can you ship my car(s)? Will they be in the moving van or towed?

- What are the charges for shipping cars, lawn tractors, etc?

- What items cannot be shipped?

- If a shuttle truck is needed because of the location of my house or size of the drive way, is there an additional charge?

- If packing and loading are on different days, can you leave the beds and other basics out for us to use?

Dates

- What dates are available for our move?

- What date will you pack and how long will this take?

- What date will you load the van?

- What date will the van arrive at my new location?

- If my new home is not ready for delivery, how many days can it be delayed before there is a charge?

- What is the charge for additional days or weeks?

Terms

- Are there any additional fees that I’m responsible for that have not been discussed?

- What are the terms of payment?

- Is a down payment required?

- When will the balance be due and who is authorized to accept it?