Rental homes have several distinct advantages compared to alternative investments. These advantages coupled with the opportunity for a higher yield make it a clear choice for some investors.

- Most investments must be paid for in cash. Stocks can be purchased with 50% cash but if the value goes down, more cash has to be used to keep the margin at 50%. Rentals can readily be financed with only 20-25% down payment.

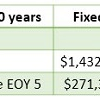

- Most loans made for business or investment purposes are at a floating interest rate compared to the prevalent fixed-rate mortgage on non-owner occupied real estate.

- Terms for investment loans if possible are generally six months to a year with a possible renewal but real estate commonly has long term loans up to 30 years.

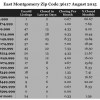

- Real estate has a long-term history of appreciation.

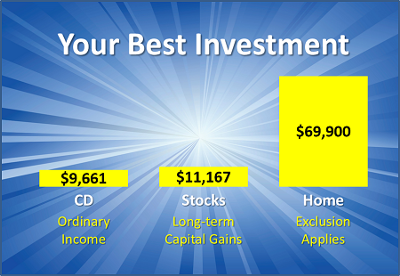

- Real estate enjoys tax advantages like long-term capital gains treatment, cost recovery and tax deferred exchanges that are not available to many other types of investments.

- Single family homes and similar properties give the investor a reasonable amount of control to make improvements and manage the property which are limited to simply determining when to buy and sell for other investments.

The ins and outs of stocks, bonds, mutual funds, commodities and other investments are unfamiliar with most people. It is obviously possible for anyone to invest in them but the lack of knowledge about how they work could make it more difficult to have a successful outcome. On the other hand, homeowners can use their experiences to select, manage and sell with much more confidence using a single family home for rental purposes.

To find out more about investing in rental properties, contact your real estate professional.