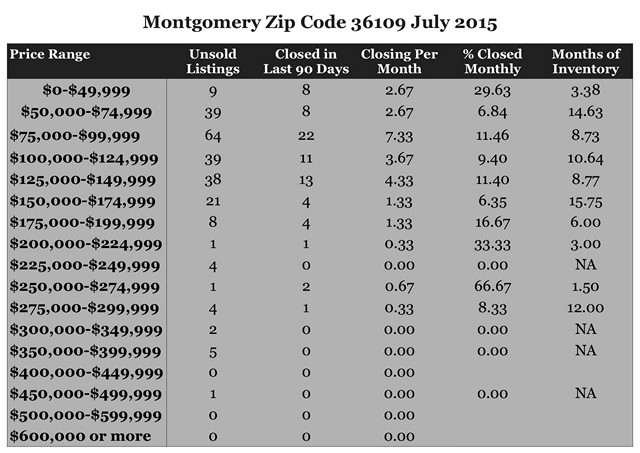

These were the existing Homes for Sale July 2015 for Zip Code 36109 in Montgomery including subdivisions Forest Hills, Lakeview Heights, Dalraida, Johnstown, Morningview, Bell Hurst, County Downs,Fox Hollow, and Carol Villa. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

July 2015 Home Sales Zip Code 36109 Montgomery, AL

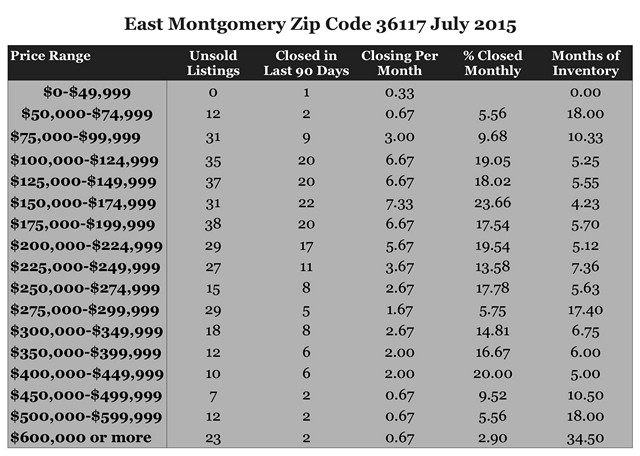

July 2015 Home Sales Zip Code 36117 Montgomery, AL

These were the existing Homes for Sale July 2015 for Zip Code 36117 in Montgomery including subdivisions Montgomery East, Halcyon, Halcyon Summit, Copperfield, Dexter Ridge, Woodmere, Bellwood, Thorington Trace, Deer Creek, Lake Forest, Arrowhead, Towne Lake, Somerset, Wynridge,and Wynlakes. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

Wait a Year…It Won’t Matter?

There is a frequently quoted expression “more money has been lost from indecision than was ever lost from making a bad decision.” Regardless of the extent of its accuracy, most people can recall when procrastination has cost them money.

There are markets so short of inventory that buyers have become frustrated after losing bids for several homes and have decided to wait until more homes come on the market. In the meantime, the shortage of homes is driving the prices up more by the month.

There are buyers who can’t find what they want for the price they want to pay and think that waiting will somehow change things. In some cases, what they want just keeps moving farther and farther away from them.

The other dynamic in play is, of course, the mortgage rates. While they’ve remained low for several years, most experts agree that they’re going to rise; it’s just a matter of when. If you look at what positive increases in both of these would do, it becomes apparent that waiting will matter.

A $250,000 home purchased today on a FHA loan at 4% for 30 years will have a principal and interest payment of $1,151.76. If a buyer were to wait a year and the price increased 5% and the rate went up by 1%, the payment would increase by over $200 a month. In a seven year period, the increased payment alone would cost the buyer over $17,000.

Use the

Cost of Waiting to Buy calculator to see how much it will matter based on the home you want to buy and what you think the prices and rates will do in the next year.

Who is Your Champion?

The Super Bowl and World Series determine the football and baseball champions. Since there can only be one champion, the other team loses the competition. In feudal times, a knight might champion for the king or a patriotic, romantic or religious cause.

Fierce competition can occur when buying or selling a home because each party wants to get the “best deal” possible. When the buyer and seller are not equally matched, and they rarely are, it is important to have a champion on your side to fight for your cause.

The price of the home, the type of financing and concessions, personal property, closing dates and possession are just a few of the many things that can be negotiated in a contract. Since the seller wants to get the most for their house and the buyer wants to pay the least, their causes are diametrically opposed.

Even after the contract is signed, removing the contingencies can cause considerable negotiations. The inspections or the appraisal could be the source of reevaluating the terms and provisions of the contract.

Negotiating the sale or purchase of a home is definitely a competition and you need a champion on your side.

It’s Hard to Imagine

With mortgage rates below 5% since 2009, you’d think any homeowner who should refinance would have already. However, it is estimated, there are approximately 6.5 million borrowers who would benefit with significant monthly savings by refinancing.

Rodney Anderson of Supreme Lending, on his weekly radio program, described a recent pipeline meeting where they reviewed every pending mortgage application his company was processing. They had seven refinancing applicants whose current mortgage was over 9% and twelve with a rate between 7% and 9%.

“Some 550,000 American homeowners with a mortgage could save $500 or more each month by refinancing at today’s rates. Over three million could save at least $200 per month.” said Ben Graboske, CTO with Black Knight Financial Services.

Getting a lower interest rate should be reason enough but eliminating the mortgage insurance should make the decision a no brainer. With increased home values, the loan-to-value ratio may no longer require mortgage insurance which would add additional savings.

Homeowners need solid information about what their home is worth and whether they’d benefit from refinancing. The most reliable solution is to talk with a qualified mortgage professional. The internet is a great place for generalized info but each person’s situation is unique.

Call if you’d like a recommendation of a trusted mortgage professional or would like to know what your home is worth.

What’s Stopping You?

The majority of tenants say they’d like to own a home but continue to pay rent and missing out on financial and emotional advantages. There seems to still be a lot of misinformation in the marketplace.

There are a number of programs for low or no down payment options. Veterans can get into a home with no down payment or closing costs. In qualifying areas, USDA has zero down payment programs. FHA requires 3.5% down payment and there are conventional programs for as little as 3% and 5% down.

People with credit issues need expert opinions about their specific situation. Borrowers with bankruptcies or foreclosures may be eligible to purchase again after certain periods of time. There are short-term fixes for some types of credit problems. There is an extended list of individual issues that a skilled mortgage professional may be able to overcome.

Most tenants realize considerably lower cost of housing by owning once the appreciation, amortization and tax savings are considered. The savings in the first year alone could easily be more than the down payment required.

Plug in your own numbers in a

Rent vs. Own to see what your real cost of housing may be. Contact us for a recommendation of a mortgage professional who can give you accurate information about your situation.

Build Equity Faster

Equity is an asset and an appreciating home is an investment. While some people have resolved themselves that a mortgage payment is a normal part of life, others have set goals to get their home paid for as soon as possible. There are several strategies that will work but they all require persistent vigilance.

A shorter term mortgage such as 20, 15 or even 10 years will not only pay off sooner, it will generally have a lower interest rate. A recent comparison at Freddie Mac’s Primary Mortgage Market Survey showed a 30 year fixed-rate mortgage at 4.04% compared to a 15 year fixed-rate at 3.20%. The fees for the shorter term were even .1% less. The shorter term with the lower rate would have a higher payment but some people consider it forced savings.

Additional principal contributions to any length fixed-rate mortgage will save interest, build equity and shorten the term of the loan. Some homeowners may apply lump sums at various times during the year such as when bonuses are paid or a tax refund is received.

Other owners might increase their payment by $100, $200 or more each month. Setting the increased payment through electronic banking would insure that you consistently make the extra amount.

Bi-weekly payments make 26 half-payments in a year which equals 13 full-payments. Because of the frequency, it reduces the interest that is due. This might work well for borrowers who are paid every two weeks but could present cash flow problems for those who are paid on schedules that don’t coincide.

Making one extra payment a year will have almost the same effect as a bi-weekly payment. The 13th payment would be completely applied to principal.

Before embarking on one of these strategies, it would be wise to verify with your lender that it complies with their policies. Check out the

Equity Accelerator to see how it could affect your loan.

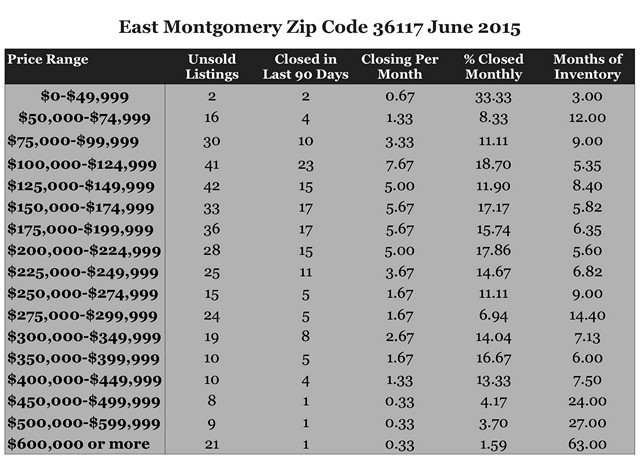

June 2015 Home Sales Zip Code 36117 Montgomery, AL

These were the existing Homes for Sale June 2015 for Zip Code 36117 in Montgomery including subdivisions Montgomery East, Halcyon, Halcyon Summit, Copperfield, Dexter Ridge, Woodmere, Bellwood, Thorington Trace, Deer Creek, Lake Forest, Arrowhead, Towne Lake, Somerset, Wynridge,and Wynlakes. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

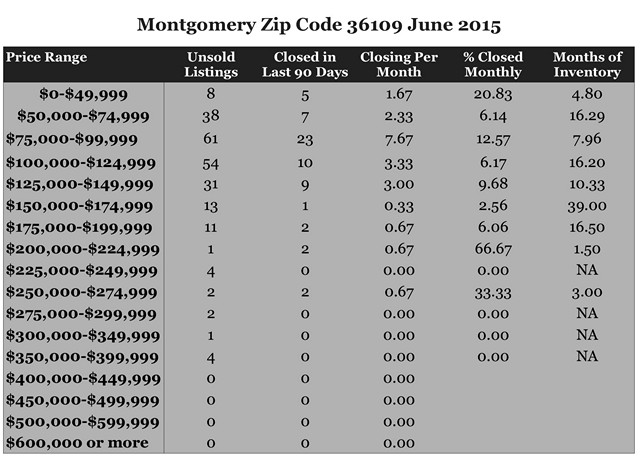

June 2015 Home Sales Zip Code 36109 Montgomery, AL

These were the existing Homes for Sale June 2015 for Zip Code 36109 in Montgomery including subdivisions Forest Hills, Lakeview Heights, Dalraida, Johnstown, Morningview, Bell Hurst, County Downs,Fox Hollow, and Carol Villa. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

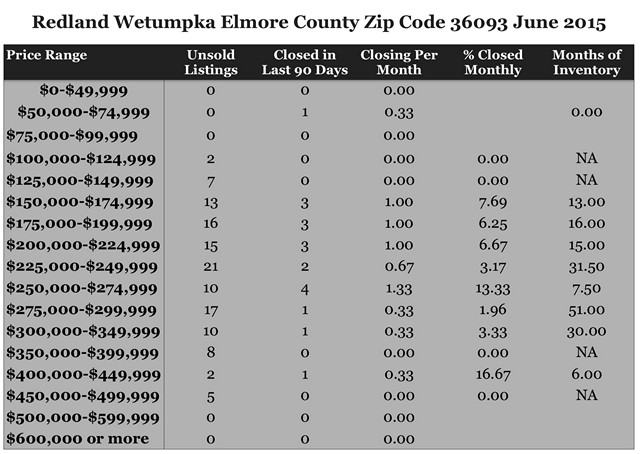

June 2015 Home Sales Zip Code 36093 Redland Wetumpka, AL

These were the existing Homes for Sale in June 2015 for Zip Code 36093 in Redland, Wetumpka, and Elmore County including the subdivisions Emerald Mountain, Blue Ridge, Mitchell Creek Estates, Grand Ridge, Jasmine Hill, Stonegate, Windsong Ridge, Wildwood, Harrogate Springs, Jackson Trace, and Brookwood. How to use: Find the Price Range in which your home falls. This will show the number of active listings (if you are selling this is your competition), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure would indicate a chance of a better bargain for a buyer. For a personalized report, feel free to contact me.