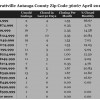

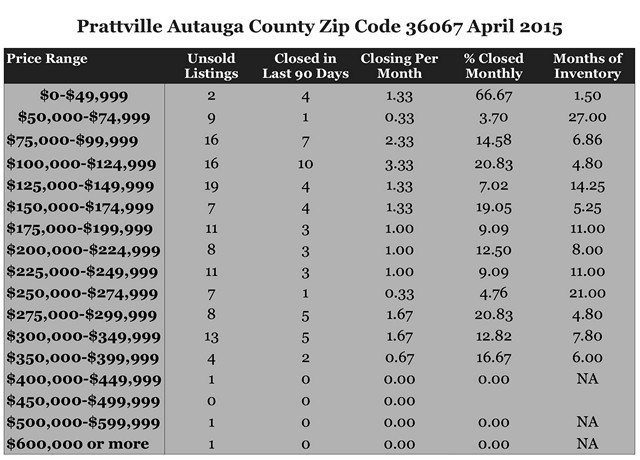

These were the existing Homes for Sale April 2015 for Zip Code 36067 in Prattville and Autauga County including subdivisions Camellia Estates, Live Oak, The Oaks of Buena Vista, Aspen Ridge, Bridge Creek Reserve, and Hearthstone How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure means a better chance of a bargain for a buyer. For a personalized report, feel free to contact me.

April 2015 Home Sales Zip Code 36067 Prattville, AL

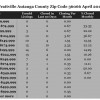

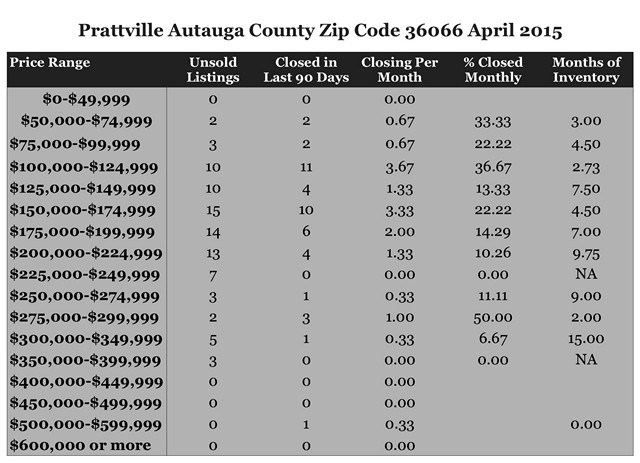

April 2015 Home Sales Zip Code 36066 Prattville, AL

These were the existing Homes for Sales April 2015 for Zip Code 36066 in Prattville and Autauga County including subdivisions Greystone, Riverchase, Woodland Heights, Silver Hills, Eastwood, The Homeplace, and The Villas at Brookstone. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure means a better bargain for buyers. For a personalized report, feel free to contact me.

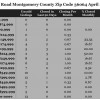

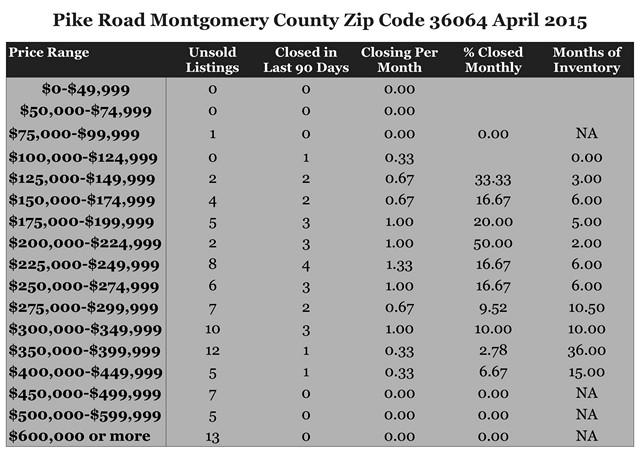

April 2015 Home Sales Zip Code 36064 Pike Road, AL

These were the existing Homes for Sale April 2015 for Zip Code 36064 for Pike Road and eastern Montgomery County including subdivisions Bon Terre, Woodland Creek, Bridle Brook, Avalon, Merrywood, Foxwood Providence and The Waters. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a chance for a better bargain for a buyer. For a personalized report, feel free to contact me.

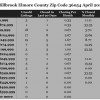

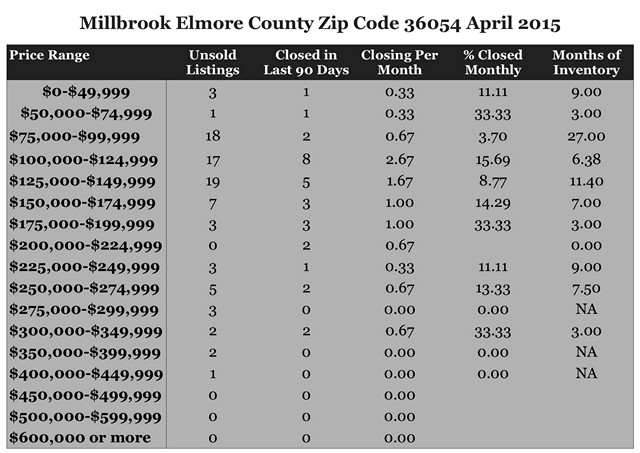

April 2015 Home Sales Zip Code 36054 Millbrook , AL

These were the existing Homes for Sale April 2015 for Zip Code 36054 for Millbrook and Elmore County including subdivisions Thornfield, Grandview Pines, Mill Ridge, Winter Lake, Magnolia Ridge, Stoney Brook, Mountain View, Bishop Place, Jamestown, Grand Oaks, Timberbrook Estates, Plantation Oaks, and The Columns. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a chance for a better bargain for buyers. For a personalized report, feel free to contact me.

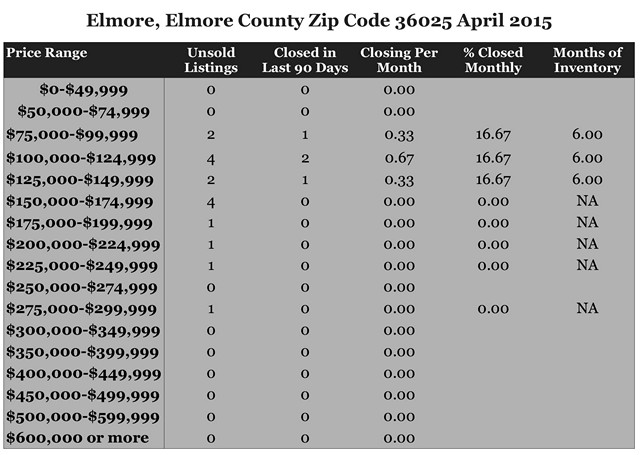

April 2015 Home Sales Zip Code 36025 Elmore, AL

These were the Existing Homes for April 2015 for Zip Code 36025 for the community of Elmore in Elmore County including subdivisions Ferndale, Meadowview, Turtle Trace, Crossgate, Silver Ridge, Diamond Oaks, Brittany Place, Brownstone and Charleston Place. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

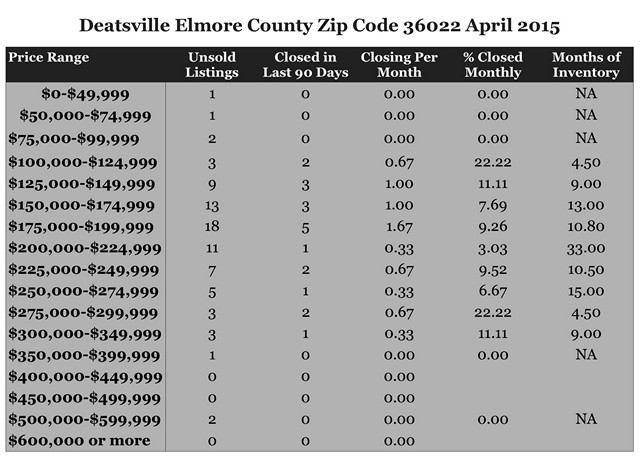

April 2015 Home Sales Zip Code 36022 Deatsville Elmore County

These were the Existing Homes for April 2015 for Zip Code 36022 for Deatsville and Elmore County including Holtville, Slapout, and part of Lake Jordan communities and subdivisions Spring Hollow, Richfield, Brookshire, Wind Mill Ridge, Dillons Run, Coosa Ridge, Green Acres, Foxwood, Plantation Ridge, Stoneybrooke Plantation, Turner’s Place, Bridlewood, Bellview Heights, Indian Hills, Meadowview, Sagewood, Kimrick Estates, Country Side Estates, The Forest, Grand Park, Summerfield, Cotton Terrace, Autumn Springs, Forest Heights, Cruise Farm Estates, Breckenridge Crescent Ridge, Savannah Trace, Wynridge, Blackberry, Ridgedale Estates, Country Oaks, Copper Ridge, and Cobblestone Run. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

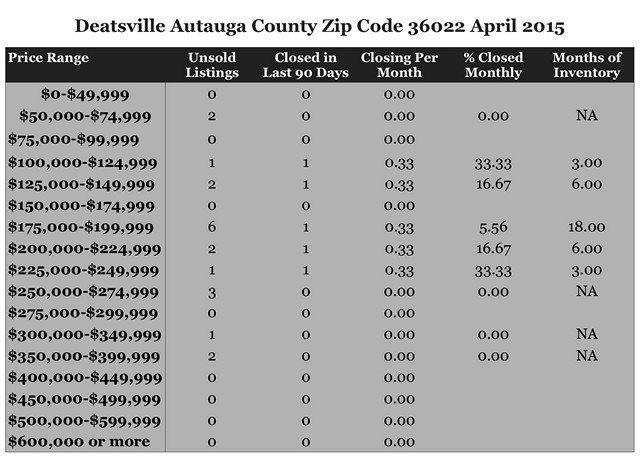

April 2015 Home Sales Zip Code 36022 Deatsville Autauga County

These were the Existing Home Sales for April 2015 for Zip Code 36022 in Deatsville and Autauga County including Pine Level, and subdivisions Graham Ridge, Rosegate, Caroline Estates, Dogwood Estates, Garden Park, Pinetuckett, Hidden Valley, Hummingbird Place, The Planes, Honeysuckle Ridge, Rushmore, Northpointe, Grand Park, Alpine Hills, Tatum Fields, Mountain Creek, Dogwood Lake Estates, Percy Place, Clear Branch, Oak Valley, and Hunter’s Trail. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

Live the Dream

Consumers are more easily living the American Dream of owning a home because of the incredibly low mortgage rates. Today, most buyers can get a much lower rate than their parents or grandparents got on their first home.

In a recent housing survey, FNMA released information about consumers’ thoughts on the current market. Almost two-thirds would rather buy than rent and believe that now is a good time to buy. Half of the respondents expect rent and home prices will go up.

Top Ten reasons to move the dream to reality:

- It’s cheaper than renting in most cases

- Avoid rental increases in the future

- Equity build-up with amortization of each payment going to principal

- A home is a forced savings account

- Appreciation increases your equity and your overall investment

- Mortgage interest and property tax deductions

- Home equity interest deduction

- A place you can call your own

- A place to share with friends and family

- Capital gains exclusion on profit

Buyers need the confidence that they can afford a home and proof for the sellers when they’re ready to submit a contract.

If a buyer has steady reliable income, a good record of paying their bills, money saved for a down payment and are prepared to pay the mortgage each month, the next step is to get pre-approved by a trusted mortgage professional.

Take a look at the Rent vs. Own to see what the real cost of owning a home for your price range.

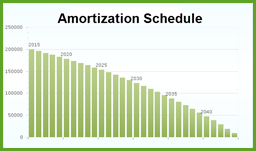

Amortization

The word describes the process of accounting that will repay a loan over time. Residential buyers will most commonly be required to have an amortized mortgage.

When amortizing a fixed rate mortgage, the payment remains constant for the entire term but the allocation of what goes to principal and interest changes with each payment that is made. Since an amount of each payment retires the principal, the interest due on the next payment is calculated on the unpaid balance after the previous payment was made.

This means that an increasing amount is applied to principal on each payment while the amount owed in interest decreases. If normal payments are made each time, on time, the loan will be completed paid off at the end of the term.

You can see in the example of a mortgage of $200,000 at 3.25% for 30 years that it has a fixed principal and interest payment of $870.41. There is $541.67 due in interest with the first payment and the remainder is applied to principal leaving an unpaid balance of $199,671.25. Since the interest due in the second payment is based on a lower principal, a little more is applied to principal.

If you’d like to have an amortization schedule for a mortgage, click here and enter the information about the loan.

Pay More or Less

Paying more for your house payment does not make your home more valuable. It does mean that the mortgage rate may be higher than it has to be.

Even though fixed rates may never again be as low as they are currently, an adjustable rate mortgage may provide the lowest cost of ownership depending on how long a borrower plans to own a home. There are different types of ARMs but the one in this example is a 30 year mortgage with the rate fixed for five years and can adjust every one year after that based on independent indexes.

Another feature of a FHA ARM is the maximum rate change in one period is 1% and the maximum lifetime cap is 5% over the initial rate.

In the example below, the payment on the adjustable is $153.48 lower for the first five years or 60 payments. Another interesting thing is that lower interest rate loans amortize faster than higher interest rate loans. In this example, the ARM has a lower unpaid balance at the end of the first five years by $4,239.

The total savings on the ARM at the end of the first period is $13,477. If a borrower felt confident they would sell the home prior to the breakeven point of 8.5 years, the ARM would produce a lower cost of housing even if the mortgage rate escalated the maximum at each adjustment period.

To help determine whether you pay more or less, consult with a trusted mortgage professional and your real estate agent to learn the advantages and disadvantages of different programs. To try your own comparison, check today’s rates at the Freddie Mac Mortgage Rate Survey and plug your numbers into an

Equity Accelerator