Imagine that after checking www.SSA.gov to see what you can expect when you retire and estimated what your minimum required distributions from your retirement accounts will be, you’ve discovered that you’re not going to have enough retirement income to cover your living expenses.

Imagine that after checking www.SSA.gov to see what you can expect when you retire and estimated what your minimum required distributions from your retirement accounts will be, you’ve discovered that you’re not going to have enough retirement income to cover your living expenses.

Ideally, it would be perfect if the extra money you need would just come to your mailbox each month with the same certainty as your social security or retirement income.

Rental homes are a popular choice for passive income because they are an investment that most people understand based on their experience owning a home. They’re easy to manage and the rents should keep pace with inflation.

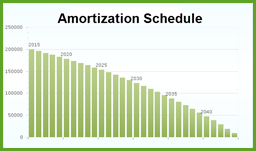

Mortgage loans for investors are available to investors with good credit and at least 20% down payments. While 30 year terms are the most common, some investors wanting to have the home paid for by retirement may choose a 15 or 20 year term.

A tried and true strategy is to choose average or slightly below average priced homes in predominantly owner-occupied neighborhoods. This will appeal to more prospective tenants wanting to live in good communities and should provide a higher level of revenue.

When an owner has a good property with a good tenant, the income is as predictable and convenient as going to the mailbox each month. To learn more about rental homes, contact your real estate professional.

Some friendly reminders when you are applying for a home loan.

Some friendly reminders when you are applying for a home loan.

![MP900341783[1] Picture of tax forms](https://montgomeryrealestateguy.com/wp-content/uploads/2011/02/MP9003417831-214x300.jpg)