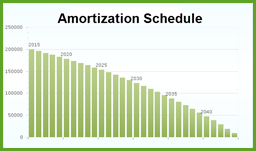

The word describes the process of accounting that will repay a loan over time. Residential buyers will most commonly be required to have an amortized mortgage.

When amortizing a fixed rate mortgage, the payment remains constant for the entire term but the allocation of what goes to principal and interest changes with each payment that is made. Since an amount of each payment retires the principal, the interest due on the next payment is calculated on the unpaid balance after the previous payment was made.

This means that an increasing amount is applied to principal on each payment while the amount owed in interest decreases. If normal payments are made each time, on time, the loan will be completed paid off at the end of the term.

You can see in the example of a mortgage of $200,000 at 3.25% for 30 years that it has a fixed principal and interest payment of $870.41. There is $541.67 due in interest with the first payment and the remainder is applied to principal leaving an unpaid balance of $199,671.25. Since the interest due in the second payment is based on a lower principal, a little more is applied to principal.

If you’d like to have an amortization schedule for a mortgage, click here and enter the information about the loan.

Many times, young adults feel “bullet-proof” and don’t consider the urgency to get involved or spend the money to take care of certain legal aspects of their lives because they think they’re going to live forever. Since no one is guaranteed longevity of life, if you want to be in control of who gets what and who is in charge now based on an untimely incapacitation or death, it is important to investigate these basic legal documents.

Many times, young adults feel “bullet-proof” and don’t consider the urgency to get involved or spend the money to take care of certain legal aspects of their lives because they think they’re going to live forever. Since no one is guaranteed longevity of life, if you want to be in control of who gets what and who is in charge now based on an untimely incapacitation or death, it is important to investigate these basic legal documents.

For whatever reason you’ve delayed buying a home, it may be time to reconsider that decision based on today’s conditions and what is expected to happen in the future.

For whatever reason you’ve delayed buying a home, it may be time to reconsider that decision based on today’s conditions and what is expected to happen in the future.

Most people’s first introduction to Radon is during the inspections of a home. It can be as much a surprise to a seller as it is a buyer. Radon is an invisible and odor-free, cancer-causing radioactive gas.

Most people’s first introduction to Radon is during the inspections of a home. It can be as much a surprise to a seller as it is a buyer. Radon is an invisible and odor-free, cancer-causing radioactive gas.