The profit potential in single family homes for investment has been a consistently good long-term investment. They offer investors the opportunity of high loan-to-value mortgages at fixed interest rates for 30 years on appreciating assets, tax advantages and reasonable control that other investments don’t offer.

The profit potential in single family homes for investment has been a consistently good long-term investment. They offer investors the opportunity of high loan-to-value mortgages at fixed interest rates for 30 years on appreciating assets, tax advantages and reasonable control that other investments don’t offer.

Last year, Warren Buffett said that if he had a way of buying a couple hundred thousand single-family homes, he would load up on them. Blackstone group L.P. (BX) has now purchased over 30,000 homes and American Homes 4 Rent (AMH) has more than 19,000 for rental purposes.

Individual investors actually have an advantage over the institutional investor but if they are not familiar with rental real estate, some basic rules could be very helpful.

1. Invest now to get more in the future.

Whether it is time, effort or money, the prudent investor is willing to forego immediate gratification for something more at a later date.

2. Real estate is an IDEAL investment.

IDEAL is an acronym that stands for income, depreciation, equity build-up, appreciation and leverage.

3. Invest in single family homes in predominantly owner-occupied neighborhoods at or below average price range.

This strategy should involve homes that will increase in value, rent well and appeal to an owner-occupant in the future who will pay a higher price than an investor.

4. Location, location, location.

The same homes in different areas will not behave the same. You can improve the condition, modify the terms or adjust the price but the location can’t be changed.

5. Understand your strategy – buy and sell, buy and hold or buy, rent and hold.

These three distinct strategies involve big differences in acquisition, management and taxation.

6. Know where your profit is coming from before you invest.

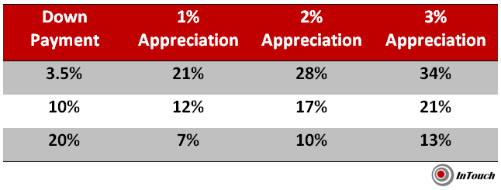

The four contributors to profit are cash flow, appreciation, amortization and tax savings. They don’t contribute equally or the same in all investments.

7. Profit starts with purchase.

Buying the property below market value builds profit into the investment initially.

8. Risk is directly proportionate to the reward involved.

An investment that has a high degree of upside also will have considerable downside possible.

9. Avoid functional obsolescence unless you have a plan before you buy.

The lack of usefulness or desirability of a home that exists when you buy it will still be there when you sell it. Unless it can be cured, it will affect future profit.

10. Good property + good tenant + good management = great investment.

These are three solid components for a successful investment.

11. Problems left unresolved have a tendency to get worse.

It is generally cheaper in time or money to fix a problem earlier rather than later.

If you’d like more information about the opportunities in our market, contact me.

A home is a place to call your own, raise your family, share with your friends and feel safe and secure. It is also one of the largest investments most people have.

A home is a place to call your own, raise your family, share with your friends and feel safe and secure. It is also one of the largest investments most people have.