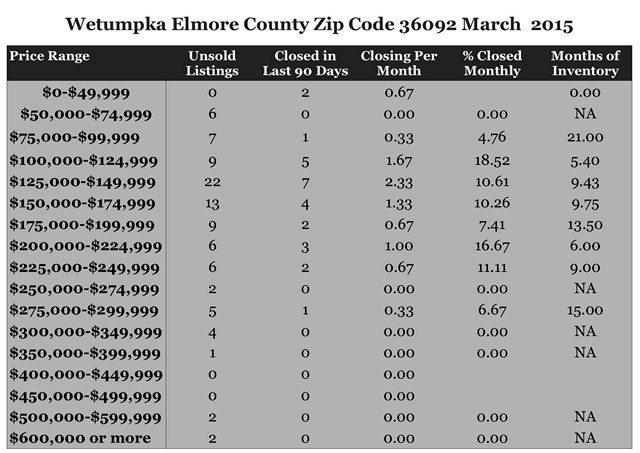

These were the existing Homes for Sale March 2015 for Zip Code 36092 in Wetumpka, Holtville, Dozier, Wallsboro, Lake Jordan and Elmore County including subdivisions Cotton Lakes, Jordan Trace, River Oaks, Macon Place, Cherokee Estates, Stone River, Country Club Estates, Cadens Creek, and Foxfire. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling your home), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

March 2015 Home Sales Zip Code 36092 Wetumpka, AL

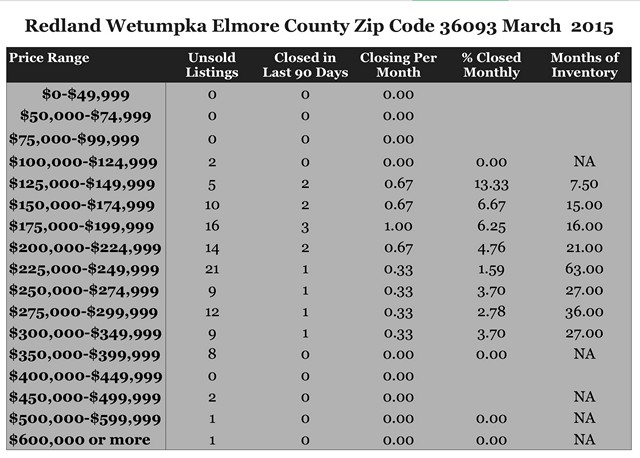

March 2015 Home Sales Zip Code 36093 Redland Wetumpka, AL

These were the existing Homes for Sale in March 2015 for Zip Code 36093 in Redland, Wetumpka, and Elmore County including the subdivisions Emerald Mountain, Blue Ridge, Mitchell Creek Estates, Grand Ridge, Jasmine Hill, Stonegate, Windsong Ridge, Wildwood, Harrogate Springs, Jackson Trace, and Brookwood. How to use: Find the Price Range in which your home falls. This will show the number of active listings (if you are selling this is your competition), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure would indicate a chance of a better bargain for a buyer. For a personalized report, feel free to contact me.

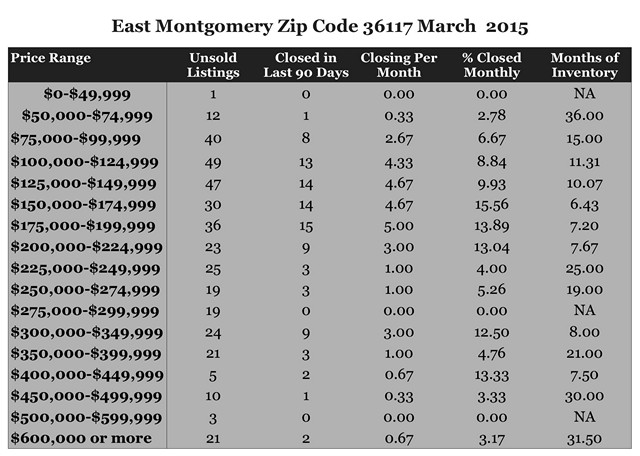

March 2015 Home Sales Zip Code 36117 Montgomery, AL

These were the existing Homes for Sale March 2015 for Zip Code 36117 in Montgomery including subdivisions Montgomery East, Halcyon, Halcyon Summit, Copperfield, Dexter Ridge, Woodmere, Bellwood, Thorington Trace, Deer Creek, Lake Forest, Arrowhead, Towne Lake, Somerset, Wynridge,and Wynlakes. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

Rent Again?

After you take the training wheels off your bike and learn to ride it, you’d never consider putting them back on again. Similarly, once you’ve owned a home, you might think you’ll own a home from now on but there may be some situations where it might make sense to rent again.

Big shifts in a person’s life like a divorce, death of spouse, empty nesting or a temporary transfer to a new city are certainly things that may warrant renting, at least temporarily, until those circumstances develop the particulars.

A good example might be that you think you’d like to move downtown. Before selling your home and purchasing a condo, it might be enlightening to rent an apartment to see how you’ll adapt to the changes in that style of living.

The sales and purchase expenses incurred with real estate are absorbed over the period ownership which is usually between ten and twelve years. When the holding period involves only a few years, it can negatively impact a homeowner’s equity.

Like any move, especially coordinating the sale and purchase of two homes, there are a lot of issues involved. Your real estate professional can provide information that will help you to make better decisions on whether to buy, sell or rent again.

Home Too Big Now?

Once the kids are grown, have careers, relationships and get a place of their own, parents find that they may not need their “big” home like they did before. Their lifestyle may have changed and the house just doesn’t “fit” anymore.

Benefits of a smaller home:

- Easier to maintain

- Lower utilities

- Lower property taxes

- Lower insurance

- More convenient location

- Convenience of a single level

- Possibly more energy efficient

- Possibly lower maintenance

Moving from a larger home frees equity from the previous home that can be invested for retirement income, purchase a second home, travel, education or just to have a nest egg for unexpected expenses. The profit on the home, in most cases, will be tax-free up to the exclusion limits set by IRS.

There will be expenses involved in selling a home as well as the purchase of a new home. These will lower the amount of net proceeds available to invest in the new home.

Like any other big change in life, it is recommended that you take your time to consider the possible alternatives and outcomes. Your real estate professional can provide information that can be valuable in the discernment process such as what your home is worth, what you will net from a sale as well as alternative properties for your next stage in life.

FHA or Conventional?

Buyers with a minimum down payment are generally faced with the decision of whether to get a FHA or a conventional loan. With the new 3% down payment program on conventional loans, it may become more confusing which loan to pursue.

The two loan programs have mortgage fees that can differ greatly. FHA has a 1.75% up-front mortgage insurance charge in addition to the monthly mortgage insurance charge which was recently lowered by .5%.

FHA’s mortgage insurance is a fixed amount where conventional mortgage insurance providers’ fees are determined by individual companies and according to the credit score of the borrowers. A borrower with a good credit score will be charged less than a borrower with a marginal credit score.

Mortgage insurance on conventional loans can be cancelled when the equity in the property reaches 20%. FHA mortgage insurance in most cases, is paid for the life of the mortgage. Once a borrower has a 20% equity in their home, to eliminate the monthly FHA mortgage insurance, they would need to refinance the home with a conventional loan and would not be eligible for any refund of the up-front fee paid at closing or added to the mortgage.

If a borrower has a low credit score, FHA may be the better choice because conventional underwriters may have a higher minimum score. FHA loans also tend to be more lenient than conventional loans when a borrower’s total monthly debt exceeds 45% of their monthly income. FHA tends to allow borrowers a shorter time frame after foreclosures and bankruptcies.

The decision-making factor is which mortgage will provide the lowest cost of housing including payment and all loan fees. A lot of information is necessary to make a good decision and typically, the borrower isn’t able to acquire it on his/her own.

A trusted mortgage professional is very valuable in not only providing the information but guiding the borrower through the entire process. Your real estate professional is uniquely qualified to make such a recommendation.

Selecting a Lender

Finding a mortgage lender is not a problem. Selecting someone who will help you find the best loan product for your situation even if it means sending you to another lender is paramount.

There is a huge advantage to be able to sit across the table from someone you’re doing business with and look them straight in the eye. It’s difficult to make an informed decision based on a website and a phone call.

Doing business with a full-time professional who specializes in residential loans like you’re trying to get is important. You want the loan officer to be familiar with local conditions, values and practices.

It’s to your benefit to have a loan officer who has the experience to put the unusual transaction together even if yours is not.

Here are a few questions that will be helpful in selecting the right loan officer.

- What percentage of your business are FHA & VA compared to conventional mortgages and how long have you been doing them?

- What percentage of your loans close on time according to the sales contracts?

- Will my credit score affect my interest rate?

- Will you help me select the best loan product for me regardless of your commission?

- Are there prepayment penalties on any of the loans we’re considering?

- Are there any restrictions on refinancing any of the loans we’re considering?

- When is my loan rate locked-in? Is there a charge for that?

- Is your loan underwriting in-house?

A real estate professional can be your best source of information and can recommend a trusted lender. If you have any questions as to what kind of answers you should expect, please give me a call.

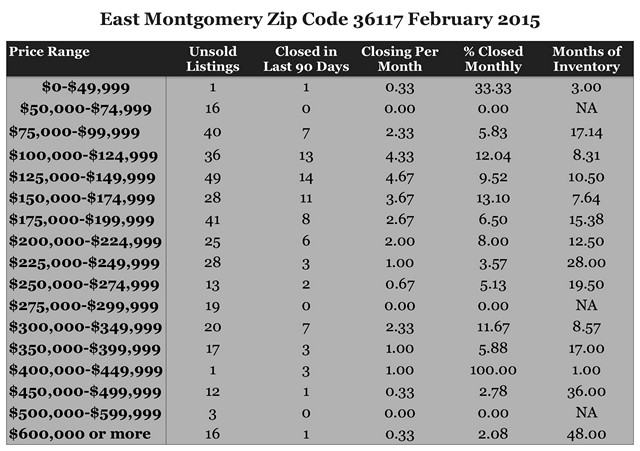

February 2015 Home Sales Zip Code 36117 Montgomery, AL

These were the existing Homes for Sale February 2015 for Zip Code 36117 in Montgomery including subdivisions Montgomery East, Halcyon, Halcyon Summit, Copperfield, Dexter Ridge, Woodmere, Bellwood, Thorington Trace, Deer Creek, Lake Forest, Arrowhead, Towne Lake, Somerset, Wynridge,and Wynlakes. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

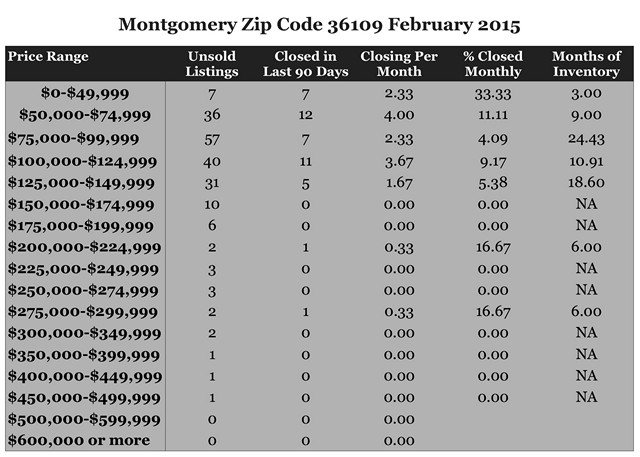

February 2015 Home Sales Zip Code 36109 Montgomery, AL

These were the existing Homes for Sale February 2015 for Zip Code 36109 in Montgomery including subdivisions Forest Hills, Lakeview Heights, Dalraida, Johnstown, Morningview, Bell Hurst, County Downs,Fox Hollow, and Carol Villa. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

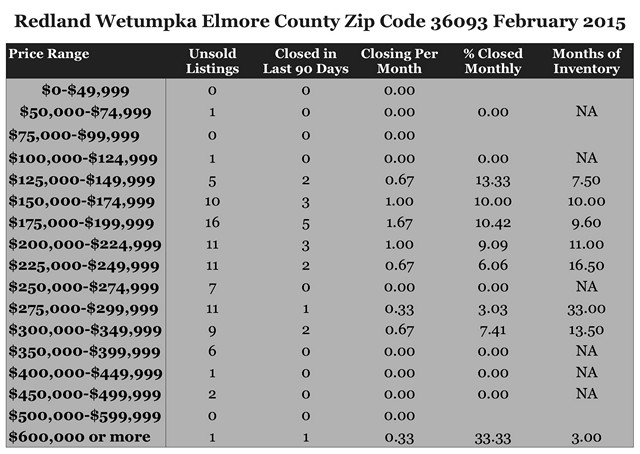

February 2015 Home Sales Zip Code 36093 Redland Wetumpka, AL

These were the existing Homes for Sale in February 2015 for Zip Code 36093 in Redland, Wetumpka, and Elmore County including the subdivisions Emerald Mountain, Blue Ridge, Mitchell Creek Estates, Grand Ridge, Jasmine Hill, Stonegate, Windsong Ridge, Wildwood, Harrogate Springs, Jackson Trace, and Brookwood. How to use: Find the Price Range in which your home falls. This will show the number of active listings (if you are selling this is your competition), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure would indicate a chance of a better bargain for a buyer. For a personalized report, feel free to contact me.