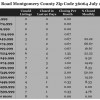

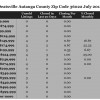

These were the existing Homes for Sale July 2014 for Zip Code 36109 in Montgomery including subdivisions Forest Hills, Lakeview Heights, Dalraida, Johnstown, Morningview, Bell Hurst, County Downs,Fox Hollow, and Carol Villa. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

July 2014 Home Sales Zip Code 36109 Montgomery, AL

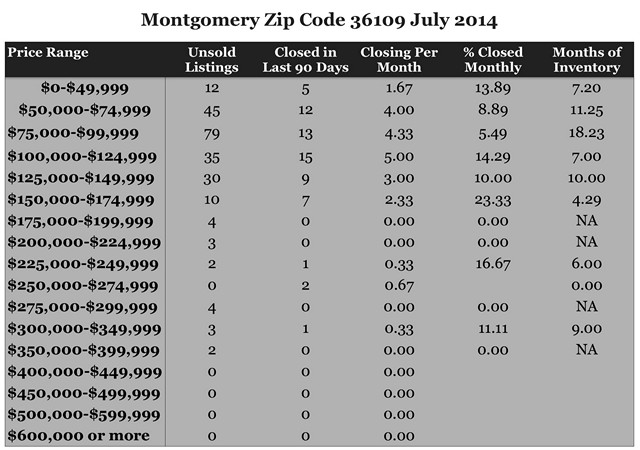

July 2014 Home Sales Zip Code 36066 Prattville, AL

These were the existing Homes for Sales July 2014 for Zip Code 36066 in Prattville and Autauga County including subdivisions Greystone, Riverchase, Woodland Heights, Silver Hills, Eastwood, The Homeplace, and The Villas at Brookstone. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure means a better bargain for buyers. For a personalized report, feel free to contact me.

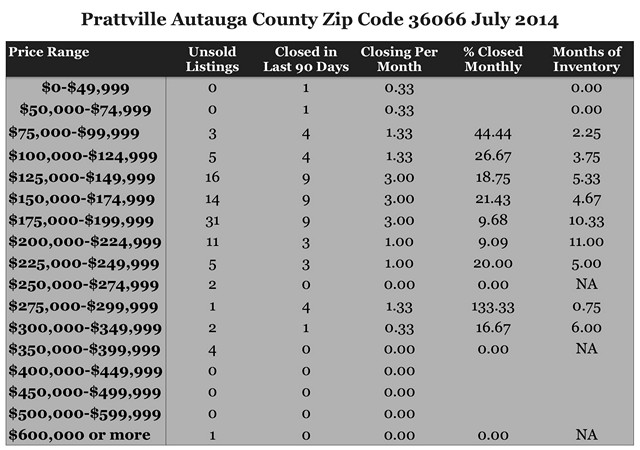

July 2014 Home Sales Zip Code 36117 Montgomery, AL

These were the existing Homes for Sale July 2014 for Zip Code 36117 in Montgomery including subdivisions Montgomery East, Halcyon, Halcyon Summit, Copperfield, Dexter Ridge, Woodmere, Bellwood, Thorington Trace, Deer Creek, Lake Forest, Arrowhead, Towne Lake, Somerset, Wynridge,and Wynlakes. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

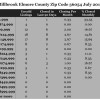

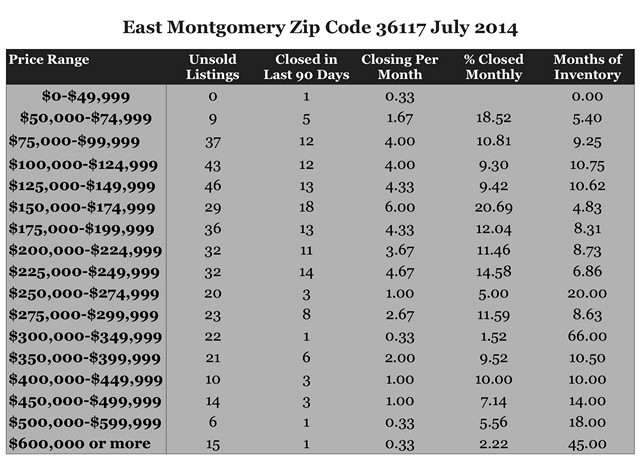

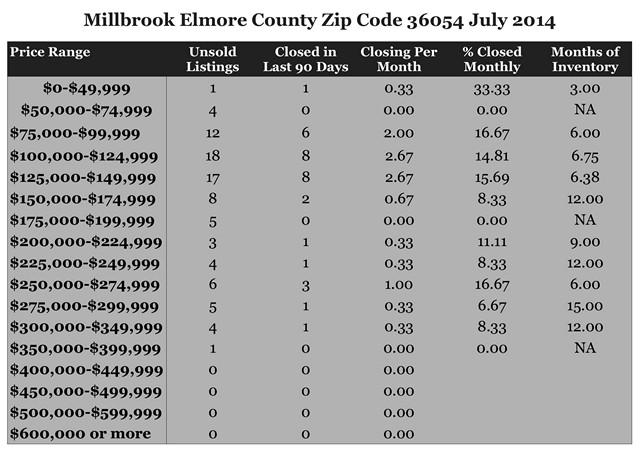

July 2014 Home Sales Zip Code 36054 Millbrook , AL

These were the existing Homes for Sale July 2014 for Zip Code 36054 for Millbrook and Elmore County including subdivisions Thornfield, Grandview Pines, Mill Ridge, Winter Lake, Magnolia Ridge, Stoney Brook, Mountain View, Bishop Place, Jamestown, Grand Oaks, Timberbrook Estates, Plantation Oaks, and The Columns. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a chance for a better bargain for buyers. For a personalized report, feel free to contact me.

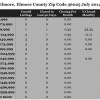

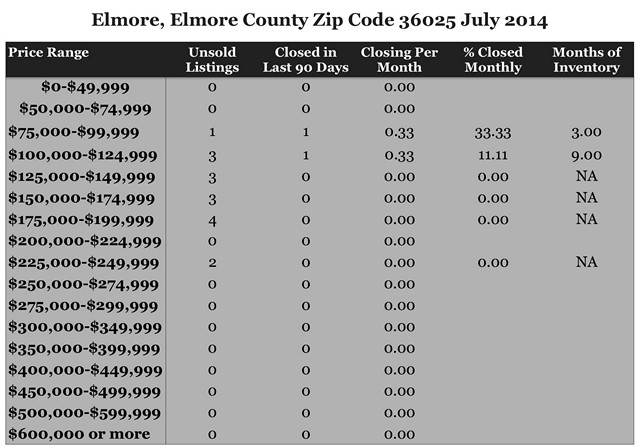

July 2014 Home Sales Zip Code 36025 Elmore, AL

These were the Existing Homes for July 2014 for Zip Code 36025 for the community of Elmore in Elmore County including subdivisions Ferndale, Meadowview, Turtle Trace, Crossgate, Silver Ridge, Diamond Oaks, Brittany Place, Brownstone and Charleston Place. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

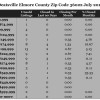

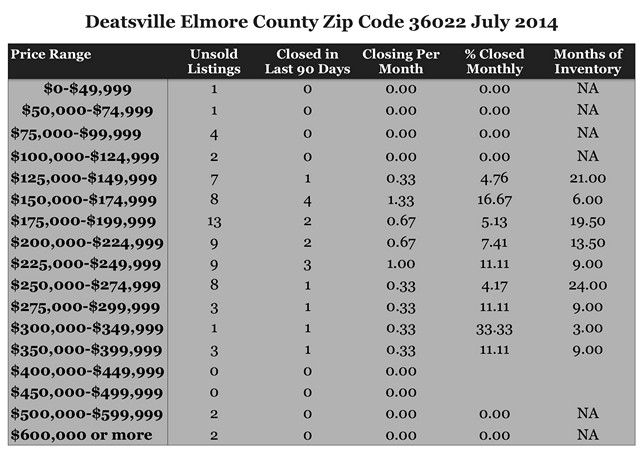

July 2014 Home Sales Zip Code 36022 Deatsville Elmore County

These were the Existing Homes for July 2014 for Zip Code 36022 for Deatsville and Elmore County including Holtville, Slapout, and part of Lake Jordan communities and subdivisions Spring Hollow, Richfield, Brookshire, Wind Mill Ridge, Dillons Run, Coosa Ridge, Green Acres, Foxwood, Plantation Ridge, Stoneybrooke Plantation, Turner’s Place, Bridlewood, Bellview Heights, Indian Hills, Meadowview, Sagewood, Kimrick Estates, Country Side Estates, The Forest, Grand Park, Summerfield, Cotton Terrace, Autumn Springs, Forest Heights, Cruise Farm Estates, Breckenridge Crescent Ridge, Savannah Trace, Wynridge, Blackberry, Ridgedale Estates, Country Oaks, Copper Ridge, and Cobblestone Run. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

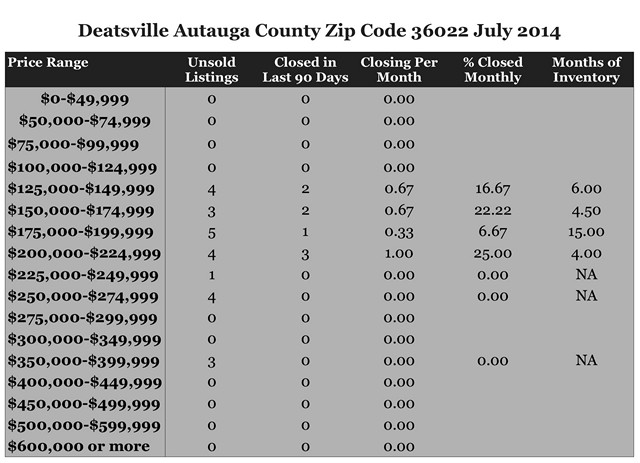

July 2014 Home Sales Zip Code 36022 Deatsville Autauga County

These were the Existing Home Sales for July 2014 for Zip Code 36022 in Deatsville and Autauga County including Pine Level, and subdivisions Graham Ridge, Rosegate, Caroline Estates, Dogwood Estates, Garden Park, Pinetuckett, Hidden Valley, Hummingbird Place, The Planes, Honeysuckle Ridge, Rushmore, Northpointe, Grand Park, Alpine Hills, Tatum Fields, Mountain Creek, Dogwood Lake Estates, Percy Place, Clear Branch, Oak Valley, and Hunter’s Trail. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

Indecision Costs

More money has been lost to indecision than was ever lost to making the wrong decision. The economy and the housing market have caused some people to take a “wait and see” position that could cost them in lost opportunities as well as almost certain higher costs in the future.

To illustrate what the opportunity cost might be, let’s compare what the value of the down payment two years from now would be if it was invested in a certificate of deposit, the stock market or used to purchase a home today.

A 3.5% down payment on a $175,000 home is $6,125.00. If it was invested in a CD that would earn 2%, a person would have $6,372 in two years. The earnings would be taxed as ordinary income tax rates. It wouldn’t earn much but it would be safe and secure.

The same amount would grow to $7,013 in the stock market if you picked the right stock or fund and it yielded 7%. The earnings would be taxed at the long term capital gains rate. The return could be greater but so is the risk involved.

If this person were to purchase a home today that appreciated 2% in value over the next two years, the equity in the home would grow to $18,769 due to value going up and the unpaid balance going down.

The question, we all must ask ourselves is “where should our money be invested?” Try Your Best Investment to see the difference it will make based on your price range, down payment and earning rate.

Every Renter Should Know

The first home purchase can be the culmination of years of planning and consideration. Buyers typically look for 12 weeks and use a variety of information sources for research before purchasing. However, many renters are not near as thorough in their study.

The first home purchase can be the culmination of years of planning and consideration. Buyers typically look for 12 weeks and use a variety of information sources for research before purchasing. However, many renters are not near as thorough in their study.

Like any other commitment a person makes, careful consideration and understanding is required. There are things that every renter should know before they rent a home or apartment.

- A lease is a binding, legal document.

- Understand the lease before signing and ask questions.

- Get the complete agreement in writing instead of verbal statements.

- Tenants have rights too and they vary depending on the state and city.

- Tenants need renter’s insurance for their personal belongings and liability.

- The landlord is responsible for a habitable and safe environment and should typically pay for repairs due to normal wear and tear.

- Do a walk-through of the property before signing a lease.

- Don’t withhold the rent to settle a disagreement with landlord.

- The landlord must return your deposit or tell you why it is being held in a reasonable time.

- It may cost you considerably less to own the home than to rent.

With the exceptionally low mortgage rates available, the house payment including taxes and insurance can easily be less than the market rent of a home. By the time you factor in appreciation, forced savings due to amortization, leverage and tax savings, the actual cost of housing could be close to half of the rent even if a reasonable repair allowance is factored. Check out your net cost of housing.

Fifteen Will Get You Three

Freddie Mac chief economist, Frank Nothaft, says that affordability, stability and flexibility are the three reasons homebuyers overwhelmingly choose a 30 year term. However, for those who can afford a higher payment, there are three additional reasons to choose a 15 year term: save interest, build equity and retire the debt sooner.

First-time buyers have a higher tendency to use a minimum down payment and are very concerned with affordable payments. It is understandable that the majority of these buyers select 30 year, fixed-rate mortgages.

Consider a $200,000 mortgage at 30 year and 15 year terms with recent mortgage rates at 4.2% and 3.31% respectively. The payment is $433.15 less on the 30 year term but the interest rate being charged is higher. The total interest paid by the borrower if each of the loans was retired would be almost three times more for the 30 year term.

Another interesting thing about the 15 years mortgage is that more of the payment is going to principal than interest from the very first payment. It would take over 13 years on the 30 year mortgage for the principal to exceed the interest allocation.

Some people might suggest getting a 30 year loan and making the payments as if they were on a 15 year loan. That would certainly accelerate amortization and save interest. The real challenge is the discipline to actually make the payments on a consistent basis if you don’t have to. Many experts cite that one of the benefits of homeownership is a forced savings that occurs due to the amortization that is not necessarily done by renters.