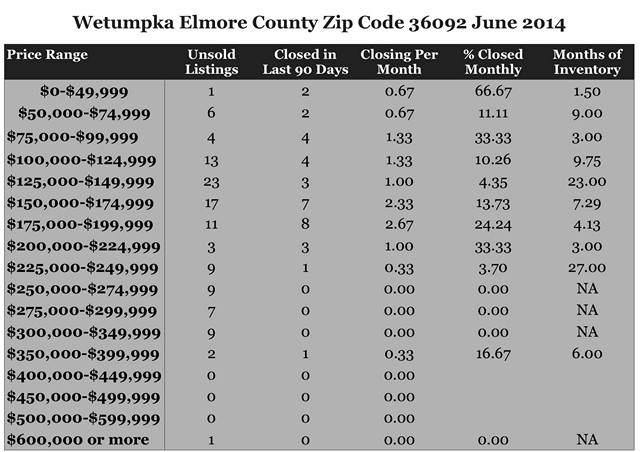

These were the existing Homes for Sale June 2014 for Zip Code 36092 in Wetumpka, Holtville, Dozier, Wallsboro, Lake Jordan and Elmore County including subdivisions Cotton Lakes, Jordan Trace, River Oaks, Macon Place, Cherokee Estates, Stone River, Country Club Estates, Cadens Creek, and Foxfire. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling your home), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

June 2014 Home Sales Zip Code 36092 Wetumpka, AL

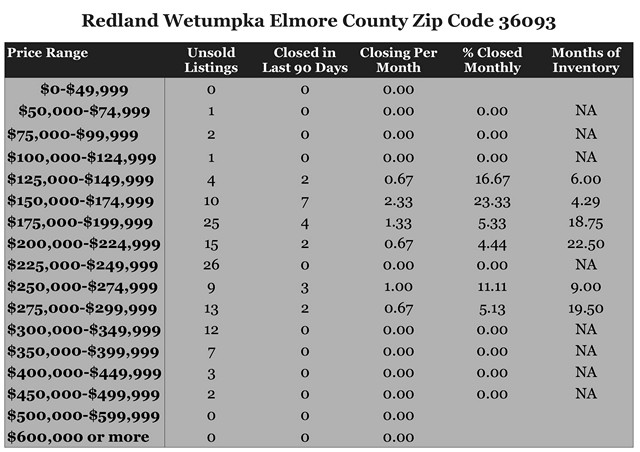

June 2014 Home Sales Zip Code 36093 Redland Wetumpka, AL

These were the existing Homes for Sale in June 2014 for Zip Code 36093 in Redland, Wetumpka, and Elmore County including the subdivisions Emerald Mountain, Blue Ridge, Mitchell Creek Estates, Grand Ridge, Jasmine Hill, Stonegate, Windsong Ridge, Wildwood, Harrogate Springs, Jackson Trace, and Brookwood. How to use: Find the Price Range in which your home falls. This will show the number of active listings (if you are selling this is your competition), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure would indicate a chance of a better bargain for a buyer. For a personalized report, feel free to contact me.

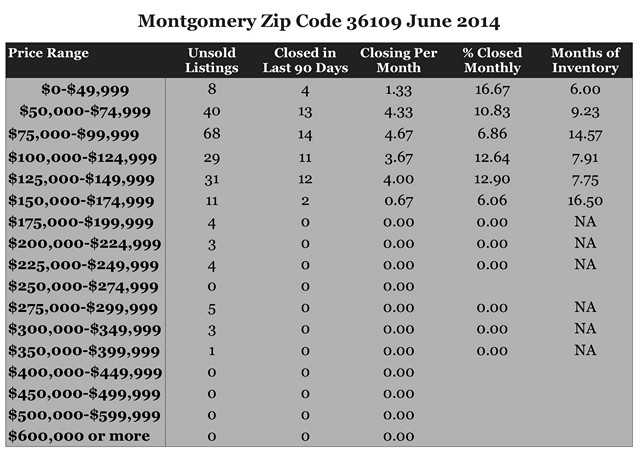

June 2014 Home Sales Zip Code 36109 Montgomery, AL

These were the existing Homes for Sale June 2014 for Zip Code 36109 in Montgomery including subdivisions Forest Hills, Lakeview Heights, Dalraida, Johnstown, Morningview, Bell Hurst, County Downs,Fox Hollow, and Carol Villa. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

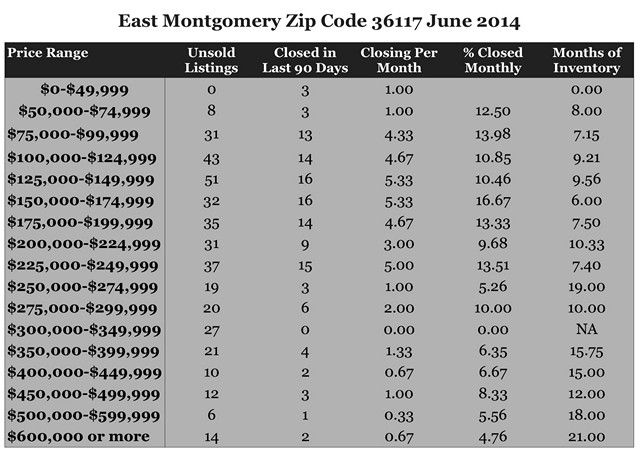

June 2014 Home Sales Zip Code 36117 Montgomery, AL

These were the existing Homes for Sale June 2014 for Zip Code 36117 in Montgomery including subdivisions Montgomery East, Halcyon, Halcyon Summit, Copperfield, Dexter Ridge, Woodmere, Bellwood, Thorington Trace, Deer Creek, Lake Forest, Arrowhead, Towne Lake, Somerset, Wynridge,and Wynlakes. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

Don’t Leave Home Without…

Planning a summer trip is usually focused on what you’ll do, see and experience. Enjoy it even more by spending a little time before you leave to make sure your home is safe while you’re gone.

Consider these suggestions along with your other normal efforts:

- Tell your neighbors you’ll be out of town and to be aware of any unusual activity.

- Notify your alarm company

. - Discontinue your postal delivery.

- Use timers on interior lights to make it appear you’re home as usual.

- Don’t make it easy for burglars by leaving messages on voice mail or posting on social networks.

- Post on social networks about your vacation after you’ve returned.

- Remove the hidden spare keys and give one to a trusted neighbor or friend.

- Lock everything, double-check and set the alarm.

- Take pictures of your belongings in case you need them.

- Disconnect TVs and other equipment in case of unexpected power surges.

- Adjust your thermostat.

- Arrange for lawn care.

- Consider disconnecting the garage door opener.

- Put irreplaceable valuables in a safety deposit box.

It’s nice to go out of town on a well-deserved trip and it’s always nice to get back home…especially when it is just the way you left it.

Another Source for a Down Payment

Most taxpayers know that they will pay a 10% penalty if they withdraw funds from their IRA before they turn 59.5 years old. There is an exception for first-time home buyers that allows a penalty-free withdrawal of up to $10,000 per person if they haven’t owned a home in the previous two years.

This would allow a married couple who each have an IRA to withdraw a lifetime maximum of $10,000 each, penalty-free for a home purchase.

In many cases, the money would be used for a down payment or closing costs. However, some buyers might consider this source to increase their down payment so they could qualify for a loan without mortgage insurance.

If the taxpayer qualifies for the penalty-free withdrawal, there may still be taxes due. Contributions to traditional IRAs are made with before-tax dollars and the tax is paid when the funds are withdrawn. Since Roth IRAs are made with after-tax dollars, there is no tax due when the funds are withdrawn.

Another interesting fact about this provision is that the taxpayer making the withdrawal can help a qualified relative which includes children, grandchildren, parents and grandparents.

Homebuyers who are considering using IRA funds for a home purchase should get expert advice from their tax professional concerning their individual situation.

Record Improvements Now

There is a significant difference in how the money you spend on your home is treated for income tax purposes. Repairs to maintain your home’s condition are not deductible unlike rental property owners who can deduct repairs as an operating expense.

There is a significant difference in how the money you spend on your home is treated for income tax purposes. Repairs to maintain your home’s condition are not deductible unlike rental property owners who can deduct repairs as an operating expense.

On the other hand, capital improvements to a home will increase the basis and affect the gain when you sell which may save taxes.

Additions to a home or other improvements that have a useful life of more than one year may be considered an increase to basis or cost of the home. Other increases to basis may include special assessments for local improvements like sidewalks or streets and amounts spent after a casualty loss to restore damage that was not covered by insurance.

Unlike repairs, improvements add to the value of a home, prolong its useful life or adapt it to new uses.

You can read more about improvements and see examples beginning on the bottom of page 8 of IRS Publication 523. For a form to keep track of money you spend, print this Improvement Register.

Cut Your Housing Costs in Half

Serious shoppers wait for a 50% off sale to make the decision because of the bargain factor. Renters who are serious about lowering their monthly cost of housing should consider buying with today’s low mortgage rates. For an example, let’s assume a person buys a $200,000 home with 3.5% down payment on a 4.5% FHA mortgage for 30 years.

The total house payment would be approximately $1,508 per month. However, once you consider the equity build-up due to normal amortization, a monthly appreciation estimated at 2% annually for this example, the tax savings and paying maintenance that a tenant wouldn’t be required to do, the net cost of housing is $772 a month. This is almost half of the full mortgage payment.

If this person was paying $1,750 a month for rent, it would cost him almost $978 more to rent than to own. In the first year alone, it would accumulate to over $11,000 which is more than the down payment required of $7,000.

Owning a home is the largest investment that most people make and the down payment of $7,000 to purchase this home would grow to $58,837 in equity by estimating a 2% appreciation and normal amortization.

To check out what your real housing costs might look like, go to Rent vs. Own or contact your real estate professional.

Who Saves the Commission?

One of the most common reasons buyers want to deal directly with the seller is because they feel they can save the commission. It’s a valid consideration but interestingly, it’s the same reason the seller isn’t employing an agent; they feel they can save the commission.

Both parties cannot save the commission. The buyer feels they have earned it because they’ve had to find the home, determine its value and negotiate with the seller. They had to arrange their own financing, title and inspections.

The seller equally feels that they have earned the commission because they have incurred all of the marketing expenses and have invested hours upon hours to be available to show the property, hold open houses and answer inquiries. They have had to research value, financing, title work and make decisions.

There is certainly value in all of the things that buyers and sellers are willing to do to save the commission but only one person can save the commission only if the buyer and seller can reach a written agreement.

There is value to having a third party advocate helping each party to the transaction.

The Profile of Home Buyers and Sellers (Exhibit 8-1) reports that 14% of sales were For-Sale-by-Owners in 2004 compared to just 9% in 2013. The trend shows that agent-assisted sales rose to 88% in 2013 from 82% in 2004.

The three most difficult tasks identified by for-sale-by-owners is attracting potential buyers, getting the price right and understanding and performing the paperwork. When surveyed, sellers most value the home selling in an anticipated time frame and for an expected amount.

The reality is that both parties cannot save the commission. It is earned by providing specific services that are essential to the transaction. The capital asset of a home represents the largest investment that most people make. An investment that important certainly deserves the consideration of a professional trained and experienced to handle the complexities involved.

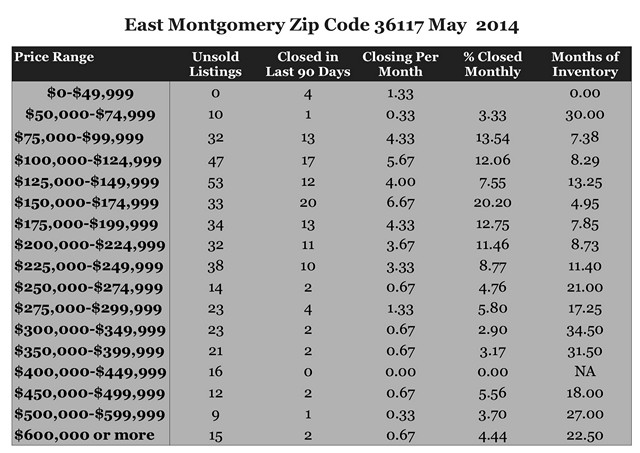

May 2014 Home Sales Zip Code 36117 Montgomery, AL

These were the existing Homes for Sale May 2014 for Zip Code 36117 in Montgomery including subdivisions Montgomery East, Halcyon, Halcyon Summit, Copperfield, Dexter Ridge, Woodmere, Bellwood, Thorington Trace, Deer Creek, Lake Forest, Arrowhead, Towne Lake, Somerset, Wynridge,and Wynlakes. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelihood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.