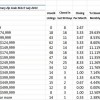

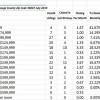

These were the existing Homes for Sale August 2013 for Zip Code 36117 in Montgomery including subdivisions Montgomery East, Halcyon, Halcyon Summit, Copperfield, Dexter Ridge, Woodmere, Bellwood, Thorington Trace, Deer Creek, Lake Forest, Arrowhead, Towne Lake, Somerset, Wynridge,and Wynlakes. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelyhood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

August 2013 Home Sales Zip Code 36117

Find the “Right” Agent Before the “Right” Home

It’s a common practice for buyers to make a list of what they want in a home during the search process and to explain it to their agent. However, maybe the first list they should make would have the skills they want their agent to have.

It’s a common practice for buyers to make a list of what they want in a home during the search process and to explain it to their agent. However, maybe the first list they should make would have the skills they want their agent to have.

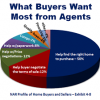

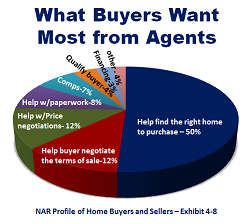

The Profile of Home Buyers and Sellers identifies what buyers want most from their agents and as you’d expect, help with finding the right home was ranked highest most often. While it is important, it may not be the most unique of the desired area of expertise.

Equally essential to the success of the transaction are the combination of help with price and terms negotiations and assistance with the paperwork, comparable sales, qualifying and financing.

To summarize the responses in the survey, Buyers want help from their agents with two things: to find the right home and to get it at the right price and terms. Some agents are actually better equipped with tools and acquired knowledge to assist buyers with financial advice and negotiations.

Since an owner’s cost of housing is dependent on the price paid for the home and financing, a real estate professional skilled in these specialized areas can be invaluable in finding the “right” home. An agent’s experience and connections to allied professionals and service providers is irreplaceable.

Ask the agent representing you to specifically list the tools and talent they have to address these areas.

A Home is More Than an Address

A home is a place to call your own, raise your family, share with your friends and feel safe and secure. It is also one of the largest investments most people have.

A home is a place to call your own, raise your family, share with your friends and feel safe and secure. It is also one of the largest investments most people have.

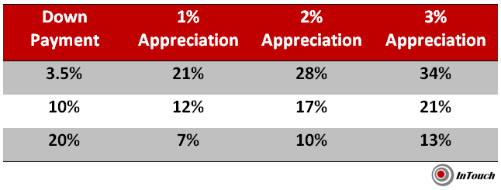

Leverage is the ability to control a larger asset with a smaller amount of cash through the use of borrowed funds. It has been described as using other people’s money to increase your yield and it applies to homeowners and investors alike. Positive leverage causes the yield to increase as the loan-to-value increases.

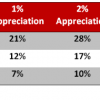

Even a modest amount of appreciation combined with the amortization of a loan can cause a substantial rate of return on the down payment and closing costs.

Homes build equity as the price goes up due to appreciation and the unpaid balance goes down due to amortization.

The example above indicates the yield on a home considering 3% acquisition costs on the home with a 4.5% mortgage rate and the resulting equity at the end of five years. The different down payments will affect the yield based on the leverage effect.

Whether you rent or buy the home you live in, you pay for what you occupy. The question a person is faced with is whether they are going to buy it for themselves or their landlord. Take a look at the cost of Renting vs. Owning.

When Rates Go Up

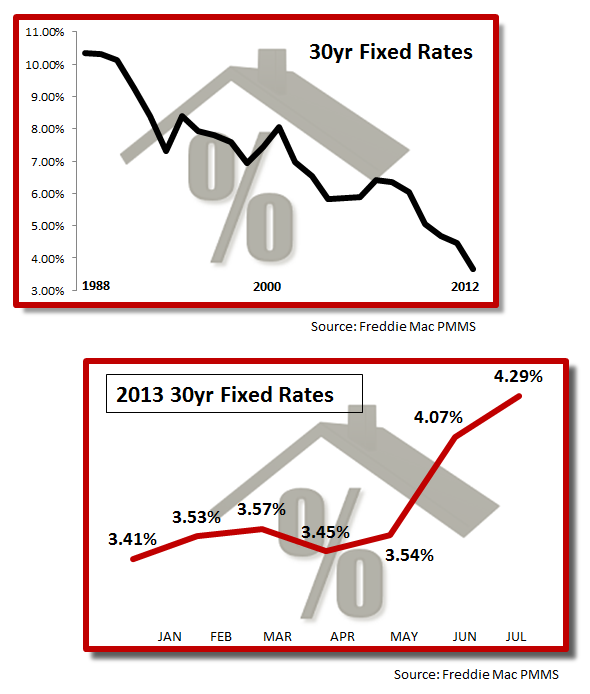

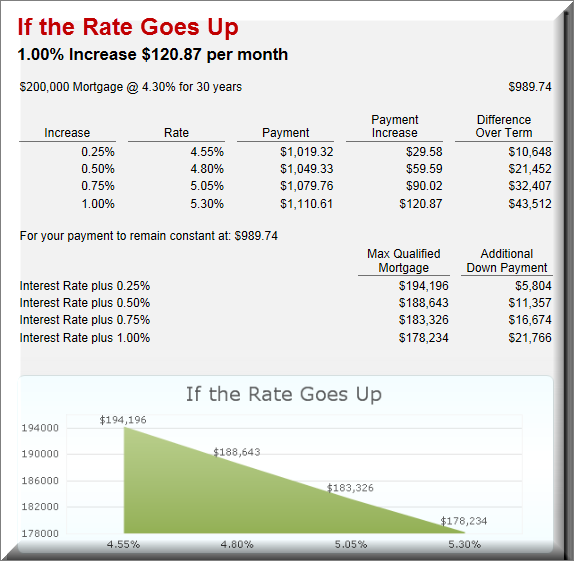

Rising interest rates are great if you are renewing a certificate of deposit but not so much when you’re borrowing money. With interest rates on the rise as well as home prices, housing affordability is a concern for would-be homeowners.

Rising interest rates are great if you are renewing a certificate of deposit but not so much when you’re borrowing money. With interest rates on the rise as well as home prices, housing affordability is a concern for would-be homeowners.

A rough rule of thumb is that a person’s or family’s housing should not exceed 28% of their monthly gross income. While rental rates and home prices have been consistently increasing, mortgage rates have been soaring in the past month. In one week, according to the Freddie Mac Primary Mortgage Market Survey, they jumped by .5%.

This means that people have to pay a larger percentage of their income for housing unless their incomes have been increasing at an equal pace. A $200,000 mortgage would be over $100 more per month if closed in July compared to closing at the interest rates available in January of 2013.

If rates increase by .5% by the time you close on the same size mortgage, payments would increase by almost $60 per month. In order to keep the payments the same, a borrower would have to put an additional $11,000 down to lower the mortgage amount.

Check out how your payment would be affected if interest rates continue to rise.

The National Association of REALTORS® suggests that housing is more affordable now than one year ago. However, with all of the variables in play including inflation that was not addressed in this piece, it is unclear how long conditions will remain “affordable”.

Get Regular Check-ups

Following his heart surgery last week, after an issue was discovered during his annual physical, President George W. Bush encouraged everyone to get regular check-ups.

Another important checkup that should be done on a regular basis and can be just as beneficial for your finances is an annual homeowner advisory. Why would you treat your investment in your home with less care than you treat your car or even your HVAC system?

Consider investigating the following:

• Know the value of your home by obtaining a list of comparable sales in your immediate area as well as what is currently on the market for sale.

• Have you compared your assessed value for tax purposes to the fair market value in order to possibly reduce your property taxes?

• Even if you’ve refinanced in the last two years, can you save money and recapture the cost of refinancing in the time you plan to remain in your home?

• Have you considered reducing your mortgage debt with low-earning cash reserves that will not be needed in the near future?

• Have you considered investing in rental homes in good neighborhoods to increase your yields and avoid the volatility of the stock market?

• Recommendations of repairmen and other service providers from a trusted source who deals with them more frequently than you do.

My goal is to create a lifelong relationship to help you be better homeowners. We want to be your “go to” person whenever you have a real estate question. We want to help you not only when you buy and sell but all of the years in between.

I want to provide good, consumer-based information about homeownership on a regular basis through email and social networking. If it benefits you by helping you be a better homeowner, hopefully, you’ll consider me your real estate professional for life.

Anytime you or your friends need help, please call. Knowing where to get the answer is just as important as knowing the answer. If you’d like information on any of the items we suggested, please let me know.

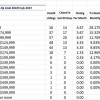

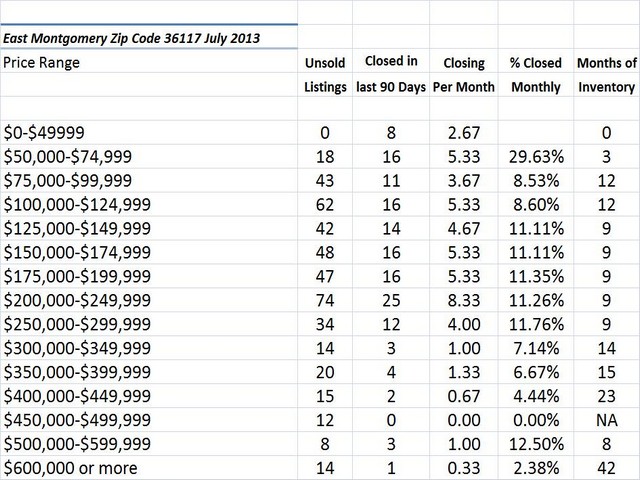

July 2013 Home Sales Zip Code 36117

These were the existing Homes for Sale July 2013 for Zip Code 36117 in Montgomery including subdivisions Montgomery East, Halcyon, Halcyon Summit, Copperfield, Dexter Ridge, Woodmere, Bellwood, Thorington Trace, Deer Creek, Lake Forest, Arrowhead, Towne Lake, Somerset, Wynridge,and Wynlakes. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelyhood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

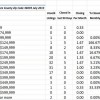

July 2013 Home Sales Zip Code 36109

These were the existing Homes for Sale July 2013 for Zip Code 36109 in Montgomery including subdivisions Forest Hills, Lakeview Heights, Dalraida, Johnstown, Morningview, Bell Hurst, County Downs,Fox Hollow, and Carol Villa. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelyhood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance for a bargain if you are buying. For a personalized report, feel free to contact me.

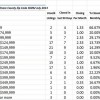

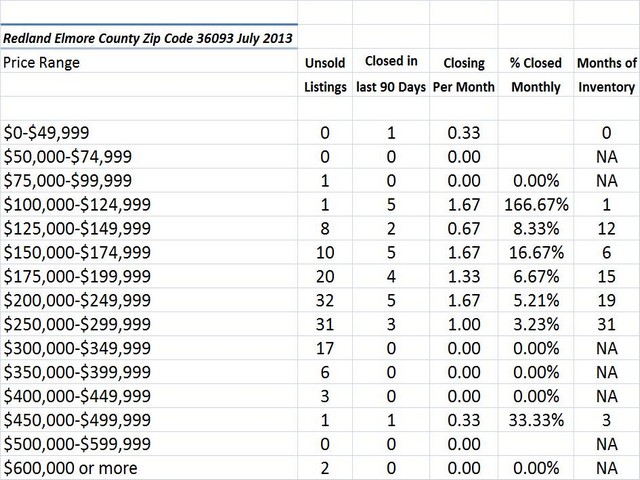

July 2013 Home Sales Zip Code 36093

These were the existing Homes for Sale in July 2013 for Zip Code 36093 in Redland, Wetumpka, and Elmore County including the subdivisions Emerald Mountain, Blue Ridge, Mitchell Creek Estates, Grand Ridge, Jasmine Hill, Stonegate, Windsong Ridge, Wildwood, Harrogate Springs, Jackson Trace, and Brookwood. How to use: Find the Price Range in which your home falls. This will show the number of active listings (if you are selling this is your competition), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelyhood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure would indicate a chance of a better bargain for a buyer. For a personalized report, feel free to contact me.

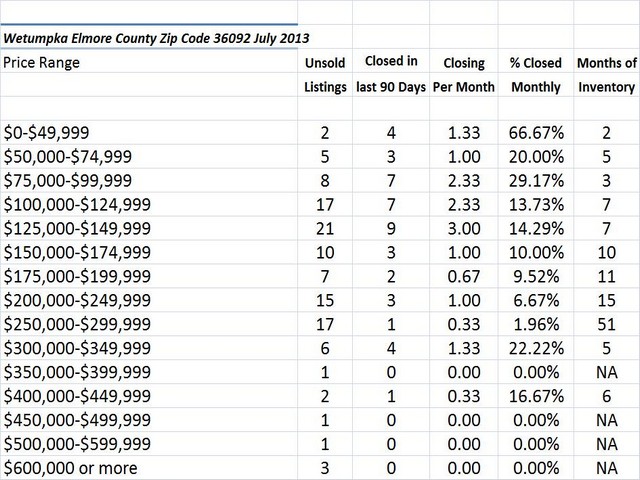

July 2013 Home Sales Zip Code 36092

These were the existing Homes for Sale July 2013 for Zip Code 36092 in Wetumpka, Holtville, Dozier, Wallsboro, Lake Jordan and Elmore County including subdivisions Cotton Lakes, Jordan Trace, River Oaks, Macon Place, Cherokee Estates, Stone River, Country Club Estates, Cadens Creek, and Foxfire. How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling your home), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelyhood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure indicates a better chance of a bargain if you are buying. For a personalized report, feel free to contact me.

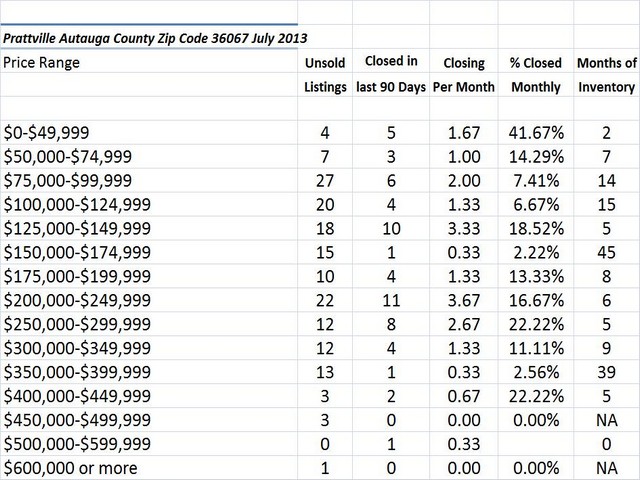

July 2013 Home Sales Zip Code 36067

These were the existing Homes for Sale July 2013 for Zip Code 36067 in Prattville and Autauga County including subdivisions Camellia Estates, Live Oak, The Oaks of Buena Vista, Aspen Ridge, Bridge Creek Reserve, and Hearthstone How to use: Find the Price Range in which your home falls. This will show the number of active listings (your competition if you are selling), the number of homes that closed in the last 90 days, the number of homes that close on average in a month, the Percentage Closed Monthly (the likelyhood that one home will close in a month), and the Months of Inventory (how many months worth of homes to sell if no other homes come on the market). A high Months of Inventory figure means a better chance of a bargain for a buyer. For a personalized report, feel free to contact me.